It’s hard to say whether we’ll plunge deep into a recession, but there are certainly signs. Layoffs abound, especially in tech: as of today, 789 tech companies have laid off 121,413 people, including thousands at Meta, Stripe, Twitter and now Amazon. 63% of economists believe there will be a recession in the next year. 75% of likely voters think we’re already in a recession.

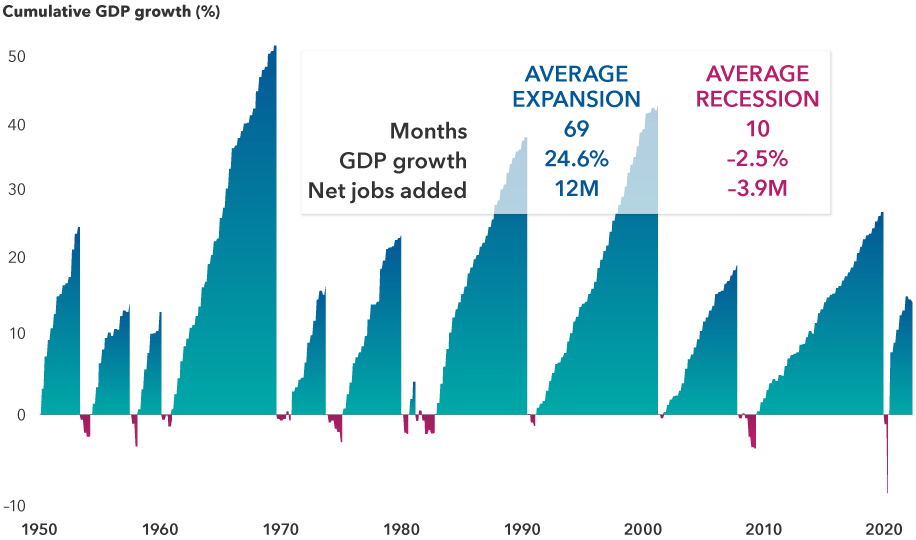

What is a recession anyway? I’ll spare you a debate over the ”official” definition, but basically it’s a protracted period where people and businesses spend less money, which causes the economy to shrink.

A shrinking economy is bad for everybody: people lose jobs, businesses lose money, bankruptcies happen, the stock market drops and lenders stop lending.

Whether a recession will happen is influenced by whether people think a recession will happen. It’s a self-fulfilling prophecy, according to Robert Schiller:

While there are many reasons behind the increasing chances of an economic downturn, from inflation to the war in Ukraine, Shiller said that he believes a recession may become a “self-fulfilling prophecy” as consumers, investors, and companies prepare for the worst and slow down their spending.

“The fear can lead to the actuality,” the famed economist argued.

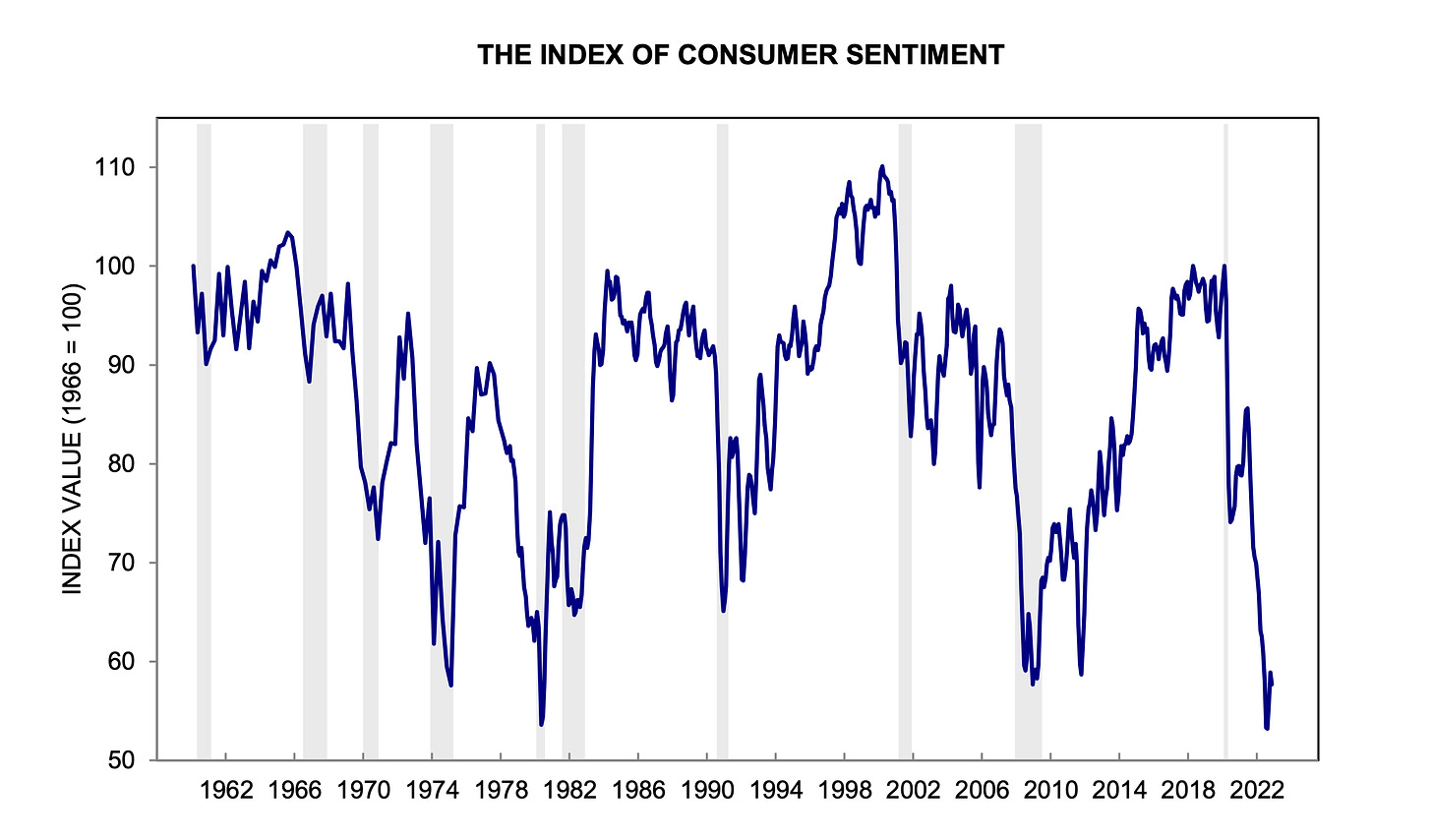

Recession predictions have flooded Wall Street to start the year, with everyone from JPMorgan Chase CEO Jamie Dimon to billionaire investors like Carl Icahn sounding the alarm. The consistent doomsday forecasts coupled with nearly four-decade high inflation have many consumers feeling pessimistic.

Consumer sentiment is at all time lows:

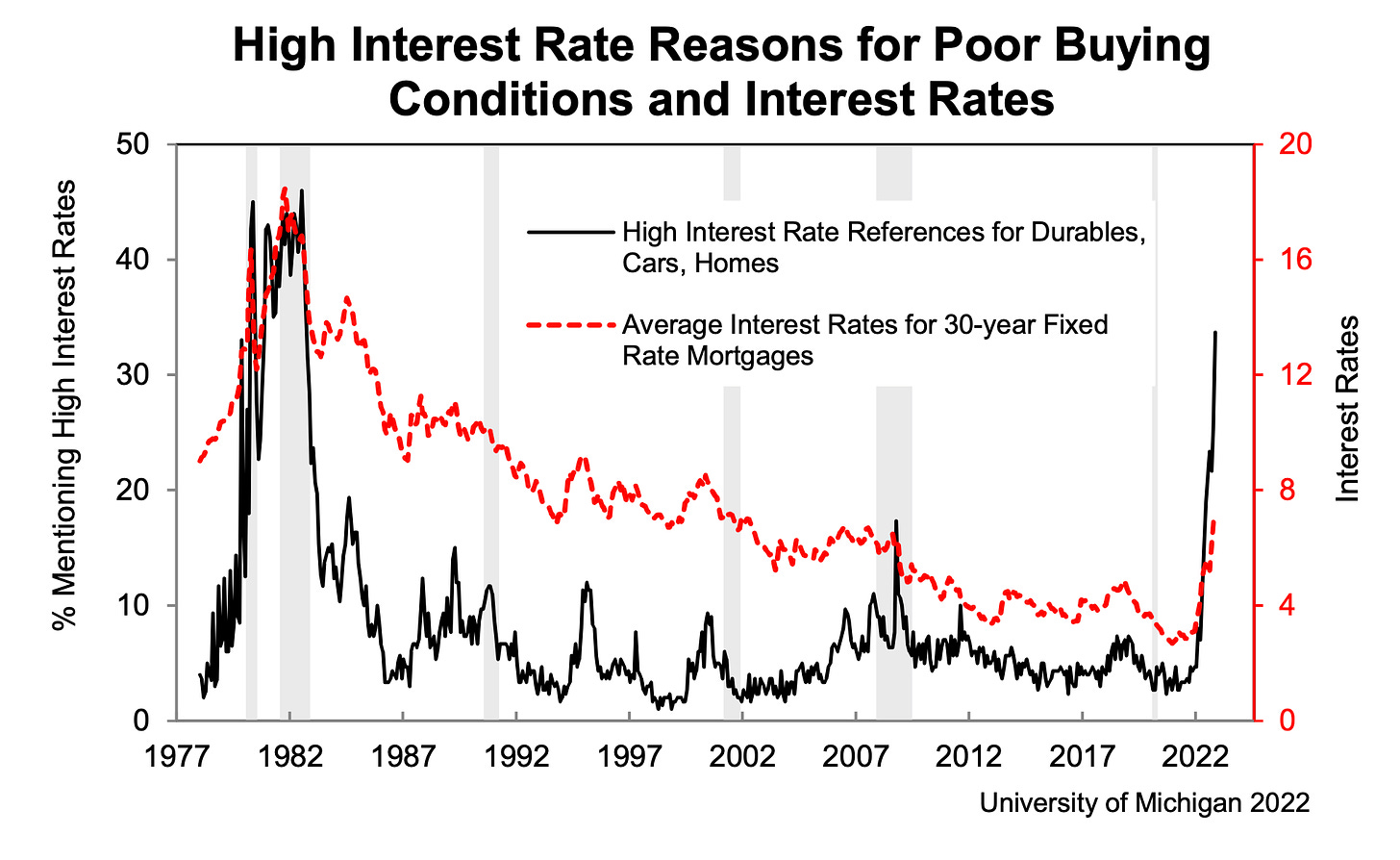

Then there’s the Federal Reserve’s rate hikes. Rising interest rates are designed to slow down the economy intentionally, in an attempt to tamp down inflation, but it’s a goldilocks scenario. Too few rate hikes won’t stop inflation, but too many will cause a recession. Consumers are avoiding purchases of high-ticket items due to high interest rates, at levels not seen since the early ‘80s:

Surviving a Recession

Since there’s a good chance a recession is coming, I thought I’d share some thoughts on how you might not just survive, but thrive in this recession.

Conventional wisdom tells us to tighten our belts and keep some cash reserves available going into a recession. You don’t want to be the last one out there spending like a drunken sailor because your income might not keep up. Jeff Bezos advised exactly that in a recent interview:

Bezos urged people to put off expenditures for big-ticket items such as new cars, televisions and appliances, noting that delaying big purchases is the surest way to keep some “dry powder” in the event of a prolonged economic downturn. Meanwhile, small businesses may want to avoid making large capital expenditures or acquisitions during this uncertain time, Bezos added.

I don’t want you to settle for survival in this recession. At 46 years old, this will be the third recession I’ve weathered as an adult. I’ve come to look at recessions as opportunities. Recessions are a time to plant seeds that you’ll harvest when people get back to spending like drunken sailors.

Sit down on ol’ Grandpa Corb’s knee and I’ll tell you a tale of recessions past, how I almost went bankrupt in 2001, and why the 2008 recession killed my startup but birthed the best chapter of my career.

2001 – The Dot Com Bust

During my first recession, the “dot com bust” of 2001, I was “furloughed” from my management consulting job. A furlough is like a temporary layoff. My firm did it like this: people who were furloughed earned 35% of salary during the furlough, and we had no obligations to perform any duties for the company during that time.

The expectation was that after 12-18 months, business would pick back up and we would all be brought back on as full-time employees. Hiring employees is slow and expensive, so this made sense for the consulting business. As an incentive to make sure we came back, the company offered a bonus equal to the 35% of salary we earned during furlough at the time of re-hire.

Assuming we came back from furlough, this meant we’d earn 70% of salary for 6-12 months for doing nothing but waiting. Sounds like a pretty good deal, right?

In my case, it was a disaster, at least temporarily. As a ~24 year old newlywed recently out of college, with a new mortgage on a fancy downtown condo, on his first “big kid” job, I didn’t exactly have my financial house in order. I was pretty much paycheck-to-paycheck at that point, with a mortgage, college loans, car payment, and an expensive restaurant + bar habit, which was amplified by becoming accustomed to living on a generous expense account. A $70k salary for a 24 year old in 2001 was great, but earning 35% of that salary indefinitely put me underwater and just a month or two from running out of money.

This is what happens to young people during a recession – it’s a cold bucket of water to the face. You assume that after college, your career will be a linear progression from the mailroom to the c-suite, with marriage, house, kids, sports car, vacation home and retirement cleanly marking the chapters. If you’re not in your early 20s anymore, you might have a hard time remembering how you thought back then. I know what I was thinking because of how off guard I was caught by that economic downturn in 2001.

So how did that recession turn out to be an opportunity for me? I gained two things from that early recession: 1) it forced me to get my financial ducks in a row and vow that I would never get so close to broke again, and 2) it made me get scrappy and figure out a way to make ends meet to crawl out of the hole I had dug for myself.

After I stopped wallowing in self pity and fear and decided to do something about my situation, I reached out to a former boss at another company. I explained my situation and that I was available for contract work. It turned out she was looking for temporary help with a new project, and the timing was perfect. Plus, since she didn’t have to pay any benefits to me as a contractor, she could offer an hourly rate 20% higher than I had earned there before.

35% of my current salary + 120% of my previous salary = suddenly I was making more than ever before. After trimming frivolous expenses, I was now able to save a good chunk of money every month.

That savings grew month over month, and is exactly what allowed me to become self-employed by starting a new company four years later. When I eventually went back to the consulting firm, they paid the additional 35% bonus, as promised. Then, over the next four years, I carefully kept my expenses low as my salary grew and my stock options became valuable when the market recovered.

If it weren’t for the recession of 2001, I might not have gotten my shit together, and I might not have been able to join an old colleague as a co-founder in a new startup when I moved to San Francisco in 2005. I had saved enough that I was able to live without a paycheck for a full year while we built the new business, without even sweating it.

I planted seeds in the recession of 2001, and harvested them in the bull market of 2005-2007, including selling a rental house before the 2008 collapse.

2008 – The Great Recession

Not all was rosy in 2008 however.

Remember that startup I co-founded in 2005? Well, we were caught in a terrible financial position in 2008. We were near the end of our runway from our Series A investment and had the impossible task of raising more money while the financial world was in turmoil. VCs were in “keep the powder dry” mode. We were a “pre-revenue” company 🤮. It couldn’t have been worse.

We had no choice but to raise a bridge round. This meant we had to lay off most of the team and just keep the lights on as we searched for a potential acquirer or another viable path.

After weighing my options, I decided to leave the company I had poured 3 years of blood, sweat, tears and money into. An agonizing decision and super stressful time, all forced on me by the recession and financial market collapse of 2008.

I was so stressed and confused, I knew I couldn’t just jump into the next opportunity. I needed to hit the reset button, clear my head, and take some time off. That’s when my wife and I packed our car and headed to Mexico on what turned into a 7-month long sabbatical, and the beginning of the best chapter of my career and life.

I wasn’t prepared for the recession, but it provided me a golden opportunity to 1) leave a business that wasn’t going anywhere, 2) take a sabbatical to really consider what I wanted to do next, and 3) completely reframe how I was going about entrepreneurship. I learned that how you build a business matters as much as what you build.

All of this led to: starting a blog, building an audience online, being able to live and work anywhere I wanted, and starting several successful businesses, including Fizzle, which I just sold this year after 10 years.

Keep your powder dry, plant seeds during recessions, harvest them during upswings.

2022 – The Post-Covid Hangover Recession?

Which brings us to this coming recession. Are you prepared for it? Will you use it as an opportunity to shake things up, and plant some seeds that you’ll harvest during the next big upswing? Or, will you be caught off guard, left to dig yourself out of a financial hole, hoping just to survive until better times?

Recessions happen. During a 40-year career, you’ll probably experience a half-dozen recessions. What you do during them might just be the difference between a mediocre career and a super successful one.

Are you feeling the effects of this recession already? Have you lost clients or been laid off? What’s your plan for weathering the storm and preparing for better times ahead? I’d love to hear your comments on the post:

Having been laid off so many times, I'm not really bothered by that fact. I have had to learn the hard way on healthy finance management. Even now, I know I'm not the pinnacle of fiscal responsibility, but I know how the levers work and definitely adjust where needed.

For me, I realize the power in the wisdom I have from life experience. Regardless of how I'm affected by the real recession (so far, things are going well), I'm still focused on my bigger picture. My vision of starting a "Wellness Village" is well into focus and I continue my work on it. I understand how I would do it with a 9-to-5 versus being unemployed.

If I can share any helpful message, it's certainly "[you] will be fine." It's just money after all. Yes, it allows us to function in society, but it's certainly not everything. I'm personally thankful for my family and friends, who I know I'll be able to support and be supported by should a global economic event happen.

Corbett, I'm glad to see you "back outside" as the kids say today. Congrats on your recent sale of Fizzle. It was definitely a great resource for me in the early days.

Thus far, the recessions hasn't hit me too hard. I still have my full-time employee role, though I certainly have noticed how much more expensive groceries are every week! I'm a minimalist in general, so I'm not usually buying too much, but I'm spending less even on splurges for myself.